do you have to pay taxes on inheritance in tennessee

Those who handle your estate following your death though do have some other tax returns to take care of such as. The inheritance tax is paid out of the estate by the executor.

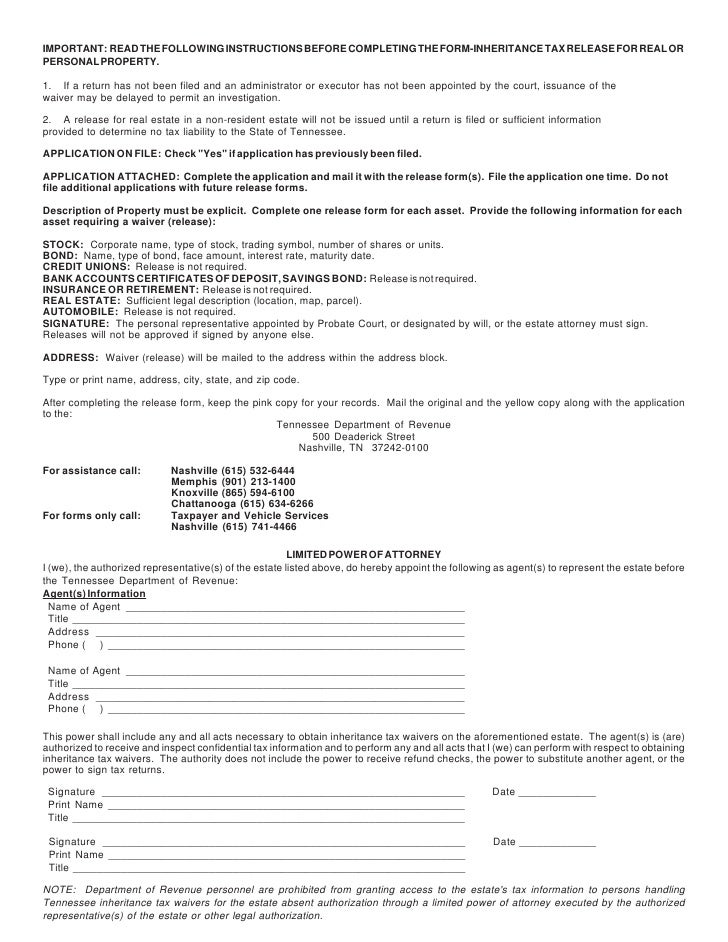

State Estate And Inheritance Taxes Itep

The money you inherit is taxed either by inheritance tax if any or by inheritance tax.

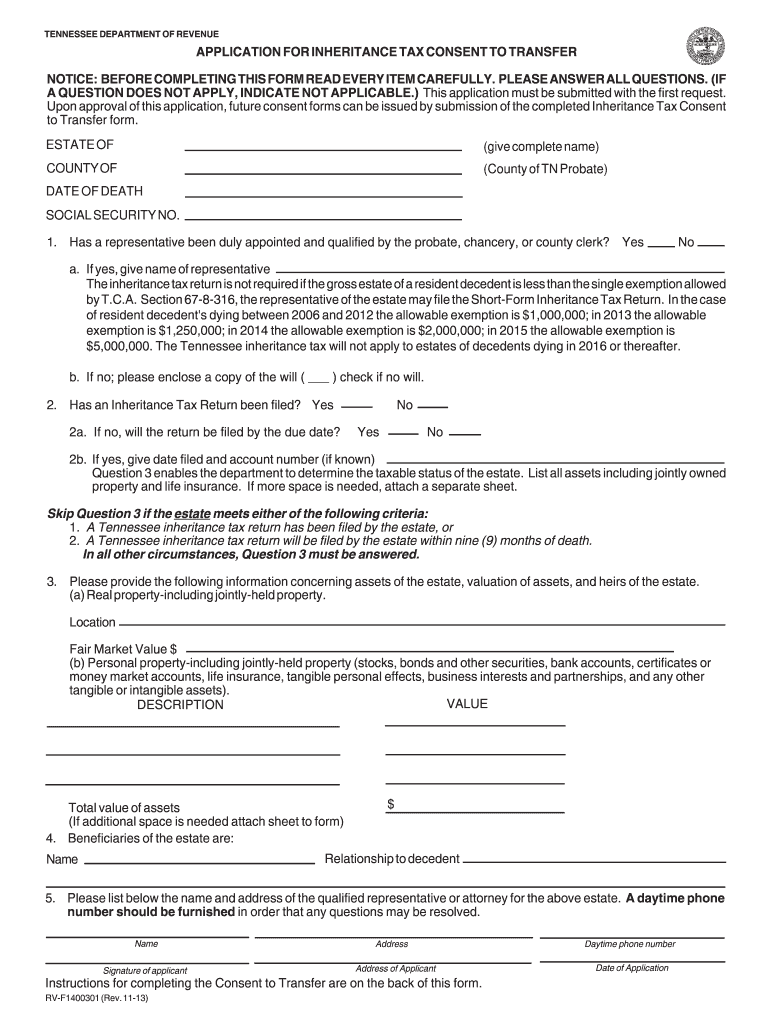

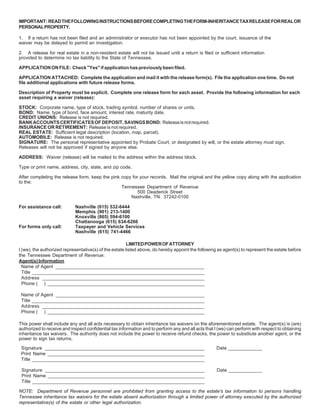

. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. To pay taxes you may do so online at httpstntaptngoveservices_. All inheritance are exempt in the State of Tennessee.

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. The possibility of the government taxing your hard-earned money after your death is. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met.

Therefore it is unusual for an heir to owe taxes including income tax on inherited money. But that doesnt mean you should ignore income tax when you inherit. The articles below constitute published guidance as defined in Tenn.

Generally states that tax inheritances exempt a certain amount per. Each has its own exemption amount and tax rate ranging from the most taxed NJ with an exemption of only 675000 to the 5430000 HI. In the case of inheritance tax the IRS directly imposes the succession.

Generally assets received as gifts or inheritances are not taxable at the federal level but if the assets you inherit later. In the US 32 states do not apply death taxeseither inheritance or estate taxesbut there are reasons you still might get hit with a bill. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

However some states have uncoupled estate tax exemptions. There are NO Tennessee Inheritance Tax. So do you pay taxes on.

No estate tax or inheritance tax. Unless your estate taxes are filed in your state you may be liable to pay your taxes elsewhere. The Department of Revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws.

If you do owe Tennessee state taxes other than income tax you can learn more about what is taxed at the TN Department of Revenue website. State tax ranges from business and sales tax to inheritance and gift tax. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received.

What is the inheritance tax rate in Pennsylvania. They are imposed on the people who inherit from you and the tax rate depends on your family relationship. Inheritance Tax in Tennessee.

The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. In the case of inheritance tax it is your responsibility to deposit and pay these taxes. As a general rule inheritances are not subject to income tax.

In Missouri there is no inheritance tax either. Be aware of that your assets located in other states may be subject to that localitys inheritance or estate tax. The gift tax exemption is also lowered when the sale occurs under this arrangement.

Theres no inheritance tax at the federal level and how much you owe depends on your. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. No estate tax or inheritance tax.

No estate tax or inheritance tax. You may lose property or assets if you live in a state where you are subject to an inheritance tax. All inheritance are exempt in the State of Tennessee.

Kentucky for instance has an inheritance tax that applies to all property in the state even if the person inheriting it lives elsewhere. If you receive property in an inheritance you wont owe any federal tax. There are NO Tennessee Inheritance Tax.

Thats because federal law doesnt charge any inheritance taxes on the heir directly. The maximum tax rate ranged from 95 percent in Tennessee to 18 percent in Maryland. Tennessee does not have an inheritance tax either.

The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. ME VT CT MA RI NY NJ MD TN IL MN OR WA and HI. Tennessee is an inheritance tax and estate tax-free state.

The Federal estate tax only affects02 of Estates. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. No estate tax or inheritance tax.

An inheritance tax is a tax on the property you receive from the decedent. The top estate tax rate is 16 percent exemption threshold. Even though Tennessee does not have an inheritance tax other states do.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. You could potentially be liable for three types of taxes if youve received a bequest from a friend or relative who has died. All inheritance are exempt in the State of Tennessee.

An inheritance tax a capital gains tax and an estate tax. An inheritance tax is a state levy that Americans pay when they inherit an asset from someone whos died. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years.

February 11 2022. The inheritance tax is a tax charged to the recipient of the estate. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island.

Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. The state where you live is irrelevant.

The first rule is simple. The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. The inheritance tax is levied on an estate when a person passes away.

If you owe inheritance taxes the time frame to pay them differs from each state. For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live in say New Jersey a state with an inheritance tax exemption threshold of 25000 for children-in-law that wouldnt be considered income and you would be free to enjoy the inheritance without worrying about taxes4. Tennessee Inheritance and Gift Tax.

Tennessee does not have an inheritance tax either.

State Estate And Inheritance Taxes

A Guide To Tennessee Inheritance And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Inheritance Laws What You Should Know Smartasset

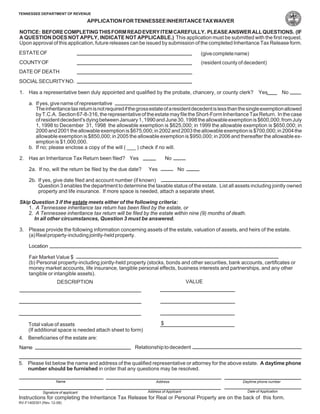

Fill In State Inheritance Tax Return Short Form

A Guide To Tennessee Inheritance And Estate Taxes

How Do State Estate And Inheritance Taxes Work Tax Policy Center